Tax Shell Game

How Much Did Offshore Tax Havens Cost You in 2010?

Tax havens are countries with minimal or no taxes, to which U.S.-based multinational firms or individuals transfer their earnings to avoid paying taxes in the United States. Users of tax havens benefit from access to America’s markets, workforce, infrastructure and security, but pay little or nothing for it—violating the basic fairness of the tax system.

Abuse of tax havens inflicts a price on other American taxpayers, who must pay higher taxes—now or in the future—to cover the government’s revenue shortfall, or must deal with cuts in government services.

Downloads

Georgia PIRG Education Fund

Topics

Find Out More

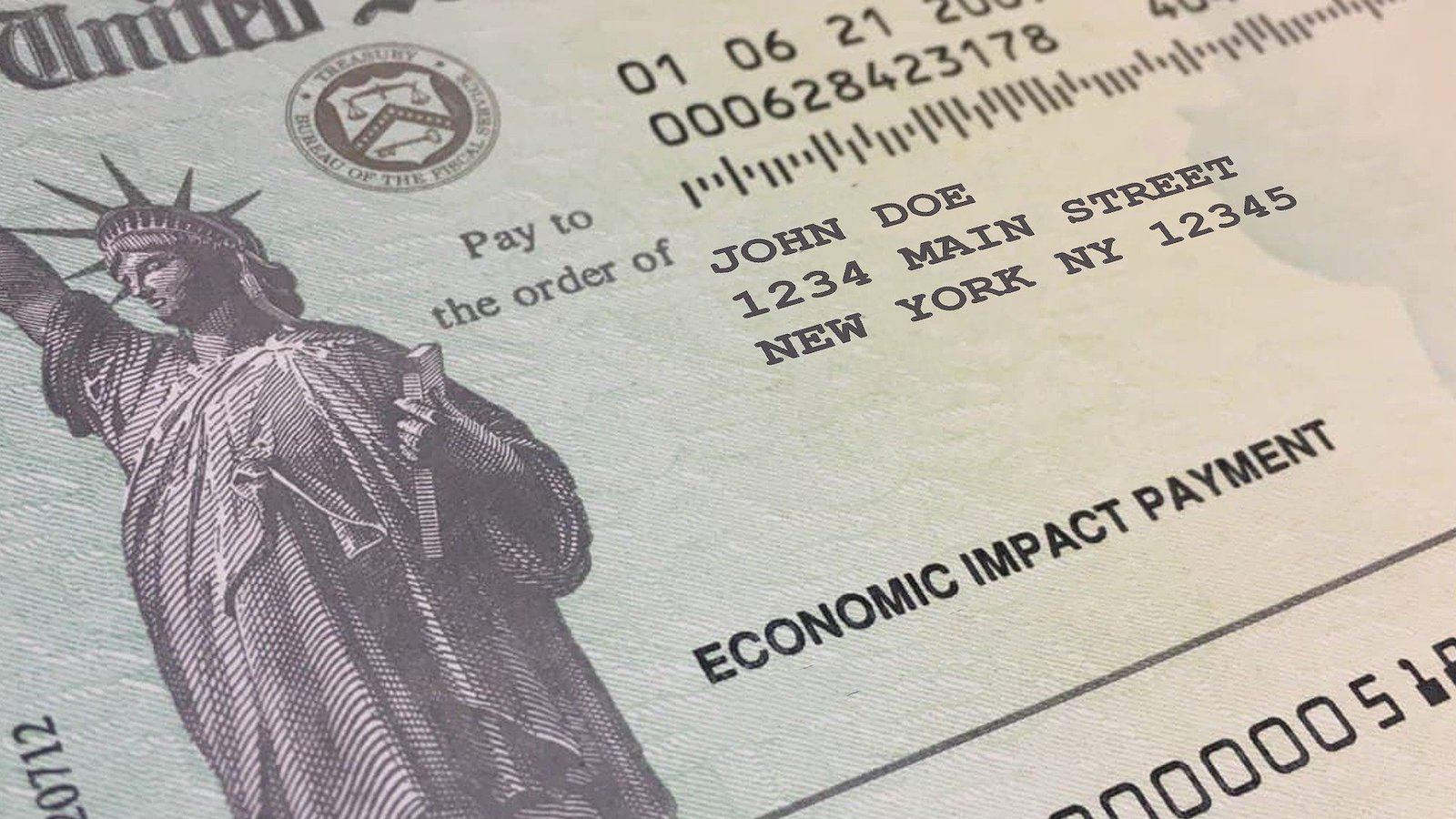

How to get your stimulus payments when you file your tax return

Fraudulent unemployment claims: You could be next — here’s what to do